The annual Index ranks 42 markets on three pillars of financial inclusion, tracks global and regional progress.

- Investment in financial technology helped both the Saudi Arabia and UAE notably improve their financial system support pillar rankings.

- Saudi Arabia (30th overall) recorded the world’s second-strongest year-over-year improvement in the financial system support pillar, rising four positions in the rankings.

- The UAE (22nd overall) is one of only three markets globally to climb more than one place in the rankings, driven by the largest upward movement in the financial system support pillar.

OCTOBER 20, 2025 – The Middle East recorded the strongest year-over-year gains in financial inclusion worldwide, according to the 2025 Global Financial Inclusion Index (the Index) from Principal Financial Group® and the Centre for Economics and Business Research (Cebr). Progress was driven by rapid advances in digital finance, fintech ecosystems, and financial education programs, with the UAE and Saudi Arabia at the forefront.

Now in its fourth year, the Index examines how governments, financial systems, and employers enable greater levels of financial inclusion across 42 markets. The report provides a comprehensive and comparative evaluation of financial inclusion on a global scale, ranking markets on a relative basis in addition to an absolute score.

Kamal Bhatia, chief executive officer and president, Principal Asset Management® said:

“Saudi Arabia and the UAE are showing how bold investment in fintech and financial literacy can accelerate inclusion, resilience, and growth. This progress is not just about digital access – it is about empowering people and businesses to help build stronger financial futures.”

Market performance deep dive

Saudi Arabia and the UAE demonstrated measurable progress in financial inclusion according to the Index, notably:

- While Saudi Arabia’s overall ranking held steady at 30th, its score rose by 0.9 points, bringing its total increase to 9.3 points since the Index launched in 2022.

- In the financial system support pillar, Saudi Arabia improved significantly, rising four spots to 35th with a 1.8 point score increase. The market was the biggest riser behind the UAE.

- The UAE was one of three markets, alongside Finland and Canada, to climb more than one position in the overall Index ranking, moving up two places to 22nd. Its overall score rose by 1.9 points – the second-largest increase after Singapore, which rose two points.

- The UAE’s improvement in the financial system support pillar ranking advanced five places, the largest across all markets.

Financial system gains drive Middle East progress in financial inclusion

For both the UAE and Saudi Arabia, the notable improvement in the financial system pillar was fueled by major investments in financial technology.

Only eight of 42 markets experienced increases in the presence and quality of fintechs indicator, with the UAE and Saudi Arabia representing two of these. The UAE showed the largest year-over-year improvement, advancing seven places to 14th, while Saudi Arabia climbed four spots to 27th.

Additionally, the UAE and Saudi Arabia are introducing regulatory initiatives to provide consumers with greater protections, such actions are positively impacting their ranking in the Index. In the consumer championing regulations indicator, Saudi Arabia and the UAE are now ranked third and fourth, respectively, with the UAE rising by three positions year over year (up 6.9 points) and Saudi Arabia by one position (up 4.4 points).

Pushpin Singh, Managing Economist, Centre for Economics and Business Research, comments:

“The Gulf’s two largest economies illustrate how sustained digital investment translates into measurable inclusion gains, even when headline rankings don’t change significantly. The UAE climbed two spots to 22nd overall on the back of the biggest jump in the financial system support pillar worldwide. A 3.9‑point surge propelled it five places to 24th as the country’s 320‑plus fintechs, worth over US $3 billion, begin to scale under the 2022 Digital Economy Strategy.

“Saudi Arabia mirrored this momentum—up four positions—thanks to a fast‑expanding fintech sector that has already met its 2025 target of approximately 230 firms and is aiming for 525 by 2030 under Vision 2030’s Fintech Strategy.

“The payoff is visible in the real economy: the UAE’s access‑to‑capital score leapt 16.6 points, while Saudi Arabia registered top‑tier gains in business confidence and SME enablement. Together, they show that fintech‑centric policy, reinforced by education and consumer trust, can fast‑track inclusion—even amid external shocks.”

Financial literacy is a key driver of economic growth

The high marks in government-provided financial education are especially insightful as this year’s Index examined the relationship between financial literacy and lower household debt defaults as a leading indicator of economic growth.

In the UAE, ranking sixth globally for government-provided financial education reflects a clear national priority to strengthen household financial capability. With current financial literacy levels at 32%, the Index shows that raising this to 50% could help boost cumulative GDP growth by 0.5 percentage points between 2026 and 2029.

Saudi Arabia also made notable strides, advancing three places to enter the top 10 at number three (up 2.7 points) for government-provided financial education. With financial literacy at 29%, raising this to 50% could generate a 0.6 percentage point uplift in cumulative GDP growth over the same period – evidence of the Kingdom’s growing emphasis on education as part of its broader economic transformation.

Access the full report and learn more about the Global Financial Inclusion Index here.

Key findings from the Global Financial Inclusion Index:

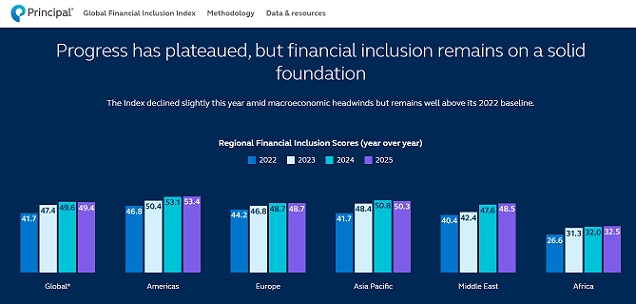

- The overall global financial inclusion score stands at 49.4 out of 100—a marginal drop of 0.2 points compared to 2024.

- However, this is markedly higher than 41.7 when the Index launched in 2022. In 2025, 20 markets showed annual improvements in their financial inclusion scores, while 19 out of the 42 markets analyzed experienced declines.

- Employer support slowed globally, with the worldwide score falling 0.6 points.

- Thirty five of 42 markets (83%) registered declines in their employer support scores – strongly suggesting that the impact of geopolitical and trade risks on business confidence have caused companies to adopt more conservative approaches to employee benefits and flexibility initiatives.

- As employers pulled back, governments and financial systems stepped up efforts to enable better access to, and understanding of, financial products and services.

- Globally, the government support score rose 0.6 points, increasing in every major region and, across the wealthier regions of North America, Europe and the Middle East, the financial system score also rose. Thirty-five markets showed year-over-year improvements for either or both government and financial system scores.

- Detailed modelling shows that higher financial literacy levels result in improved household debt management and lower borrowing costs.

- A 1 percentage point improvement in financial literacy levels is associated with a 2.8 percentage point reduction in defaults on household loans and a 6.7 percentage point reduction in household debt-to-income ratios. This has a discernible GDP benefit over the long term.

Notes to editors

* “Global” encompasses the 42 markets contained within the Index

###

About the Global Financial Inclusion Index

The Global Financial Inclusion Index ranks 42 markets on three pillars of financial inclusion—government, financial system, and employer support—using data points across public and survey-based sources. These pillars represent the key stakeholders responsible for promoting financial inclusion across the population. The Index explores the challenges and opportunities surrounding increasing access to useful and affordable financial products and services that meet their needs—transactions, payments, savings, credit, and insurance, etc.

The Index was conducted in partnership with the Centre for Economics and Business Research (Cebr). The methodology combines various data sources into one unified measure of financial inclusion at the market level.

About Principal Financial Group

Principal Financial Group® (Nasdaq: PFG) is a global financial company with approximately 20,000 employees1 passionate about improving the wealth and well-being of people and businesses. In business for 146 years, we’re helping over 70 million customers1 plan, insure, invest, and retire, while working to support the communities where we do business and building an inclusive workforce. Principal® is proud to be recognized as one of the 2025 World’s Most Ethical Companies2 and named as a Best Places to Work in Money Management3. Learn more about Principal and our commitment to building a better future at principal.com.

1 As of June 30, 2025

2 Ethisphere, 2025

3 Pensions & Investments, 2024

About Centre for Economics and Business Research (Cebr)

The Centre for Economics and Business Research (Cebr) is an independent economics consultancy with a reputation for sound business advice based on thorough and insightful research. Since 1992, Cebr has been at the forefront of business and public interest research, providing analysis, forecasts and strategic advice to major UK and multinational companies, financial institutions, government departments and agencies and trade bodies. For further information about Cebr please visit www.cebr.com.

The Global Financial Inclusion Index is a proprietary model output based upon certain assumptions that may change, are not guaranteed, and should not be relied upon as a significant basis for an investment decision.

Insurance products issued by Principal National Life Insurance Co (except in NY) and Principal Life Insurance Company®. Plan administrative services offered by Principal Life. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities offered through Principal Securities, Inc., member SIPC and/or independent broker/-dealers. Principal Asset Management® is a trade name of Principal Global Investors, LLC. Principal Global Investors leads global asset management. Referenced companies are members of the Principal Financial Group®, Des Moines, Iowa 50392.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

4877483-102025